Until moments ago (mid-day Jan. 1), when a deal was reached, Fox was threatening to black out its channels, most notably Fox broadcast, from Time Warner Cable (TWC) unless TWC anted up a subscriber fee of reportedly $1 per subscriber per month. Historically, cable networks such as HBO, Showtime, AMC, etc. got those fees, but broadcast networks didn’t. They need them now, with ad revenue shrinking, and customers departing networks in favor of cable channels — a multi-decade trend — and, more recently, video games, Internet TV sites such as Hulu, unauthorized (pirated) content, and user-generated content such as on YouTube.

Broadcast networks have started to get paid — CBS, for instance, reportedly gets up to $0.50. TWC apparently offered Fox only $0.30, but the terms of the deal they reached are undisclosed and most likely higher. Even though Fox ultimately didn’t pull the plug, it took the intervention of Senator John Kerry to keep football and “American Idol” from going dark on TWC. That’s not the sort of attention a media company wants. So why didn’t TWC just ante up the $1 and pass on the cost to consumers?

The answer is that MSO's (cable cos. like TWC) are afraid that if they keep raising cable prices, they'll drive more consumers to satellite or induce them to drop cable and just watch TV on the Internet. That is, instead of buying an Internet+cable bundle from Time Warner Cable, the customer might just drop the cable portion and buy Internet only.

Even worse for TWC: If customers opt for Internet only, some will be peeled away by telephone+Internet or cellular+Internet bundles from ATT or Verizon, causing TWC to lose the customer altogether. It’s called churn, and it’s especially likely because customer perception of cable company greed would dovetail with the belief that telcos offer better customer service anyway. Thus, raising cable prices could cost TWC dearly.

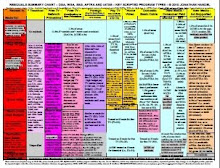

So, the battle between TWC and Fox is just another facet of an n-dimensional war between MSOs, satellite cos., landline telcos, cellular cos., cable networks, broadcast networks (ABC, CBS, CW, Fox, NBC), network affiliates (the local stations that actually broadcast the network signal), video game companies, Internet TV sites, unauthorized (pirated) content, user-generated content—and, of course, the consumer. And that's not even to mention the companies that manufacture the hardware, such as handsets, TV's, cable and satellite receivers, and other set top boxes. They’re always looking to play transmission companies off against each other and capture more of the consumer dollar.

To add to the confusion, there’s cross ownership between some of these companies but not all of them, meaning that ostensible competitors have very different profiles from each other, and also that they must often collaborate. For instance, when the Comcast – NBC Universal deal closes (assuming, of course, that it does), Comcast will control a cable system, a broadcast network, and multiple cable channels, whereas Time Warner Cable is a cable system only (that’s because Time Warner Inc. spun off TWC) and Fox’s parent, News Corp., lacks a cable system. Speaking of News Corp., throw in the fight between newspapers and Internet sites, and it’s clear that the Internet sparked a revolution that’s got everybody up in everyone else’s business. It’s the media equivalent of string theory, except that MBA’s usually have better hair than Einstein did.

———————

Subscribe to my blog (jhandel.com) for more about entertainment law and digital media law. Go to the blog itself to subscribe via RSS or email. Or, follow me on Twitter, friend me on Facebook, or subscribe to my Huffington Post articles. If you work in tech, check out my book How to Write LOIs and Term Sheets.